Refinance: It's Not as Difficult as You Think

What Does 6 Facts You Should Know About Working With A Mortgage ... Mean?

/mortgage-broker1-4eb1e0febc8548dc8e1b26a407116fff.jpg)

However it really depends who you use and whether another entity can do better for your particular loan circumstance. For example, a broker might have access to excellent refinance rates thanks to a prices unique with a given wholesale financing partner. While licensing requirements do differ by states, mortgage brokers need to be certified and finish a criminal background check consisting of fingerprinting.

Furthermore, brokers must usually complete pre-license education and some needs to secure a bond or satisfy specific net worth requirements. Yes, home loan brokers are regulated on both the federal and state level, and need to adhere to a a great deal of rules to carry out organization. In addition, consumers are able to search for broker records through the NMLS to guarantee they are authorized to conduct service in their state, and to see if any actions have been taken versus them in the past.

Normally not. Home loan brokers work with banks and lenders that ultimately fund your loan. These banks will either keep the loan on their books or offer it off to another company that may service the loan. Just put, there's a likelihood your loan servicer might change one or two times after your loan closes.

Some Ideas on Difference Between Mortgage Bankers, Loan Officers And ... You Should Know

And regardless of the ups and downs that come with genuine estate, they will more than likely continue to play an active role in the home loan market due to the fact that they offer an unique service that large banks and cooperative credit union can't imitate. So while their numbers may vary from time to time, their services must constantly be offered in one way or another.

You may be recommended one by your property representative or by a friend or family member. Everyone appears to understand one. Or you can seek out a home mortgage broker in your location by reading online reviews. It may be smart to work with somebody local who you can take a seat and meet rather than one not in your instant area.

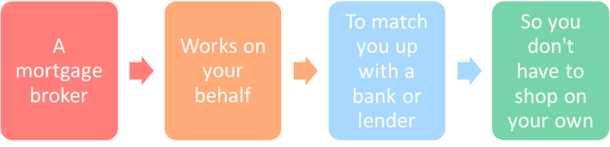

A mortgage broker functions as an intermediary who brokers mortgage on behalf of individuals or services. Generally, banks and other financing organizations have actually sold their own products. As markets for home mortgages have become more competitive, nevertheless, the function of the mortgage broker has actually become more popular. In many developed home mortgage markets today, (specifically in Canada, the United States, the United Kingdom, Australia, New Zealand and Spain), home mortgage brokers are the largest sellers of home loan items for lenders.

Getting The What Is A Mortgage Broker, And Should You Use One? - The ... To Work

Home mortgage brokers in Canada are paid by the loan provider and do not charge fees for good credit applications. Many home mortgage brokers are managed to assure compliance with banking and financing laws in the jurisdiction of the customer. The extent of the regulation depends upon the jurisdiction. Banking activities can be divided into the following: Retail banking: dealing directly with individuals and small services Organization banking: supplying services to Home loans mid-market company Corporate banking: directed at large business entities Land mortgage banking: it specializes in originating and/or serving land home loan Personal banking: offering wealth management services to high-net-worth individuals and families Investment banking: associating with activities on the financial markets Many banks are profit-making, private enterprises, nevertheless, some are owned by federal government, or are non-profits.

supervising business banks, or managing the money rate of interest. Central banks normally provide liquidity to the banking system and function as the lending institution of last resort in case of a crisis. The nature and scope of a mortgage broker's activities vary with jurisdiction. For example, anyone offering mortgage brokerage in the United Kingdom is providing a controlled financial activity; the broker is responsible for making sure the recommendations is suitable for the customers' scenarios and is held financially liable if the suggestions is later shown to be faulty.

The work carried out by the broker will depend on the depth of the broker's service and liabilities. Usually the following jobs are carried out: marketing to bring in clients evaluation of the debtor's circumstances (Home mortgage truth find forms interview) this may consist of assessment of credit rating (normally gotten through a credit report) and cost (validated by earnings paperwork) examining the marketplace to find a home mortgage item that fits the customer's requirements.

What Is The Difference Between A Mortgage Broker And A ... - Questions

The remaining 32% of loans is retail done through the lender's retail channel, which means the lending institution does not go through a broker. The home loan broker market is managed by 10 federal laws, 5 federal enforcement agencies and 49 state laws or licensing boards. [] The banks have utilized brokers to contract out the task of finding and qualifying customers, and to contract out a few of the liabilities for fraud and foreclosure onto the producers through legal contracts. [] Throughout the process of loan origination, the broker collects and processes documentation connected with mortgaging real estate.